nh tax return calculator

New Hampshires tax year runs from April 1 through March 31. Homeowners who disagree with their homes valuation can file an abatement request.

How To Calculate Transfer Tax In Nh

0 5 tax on interest and dividends Median household income.

. The new hampshire state tax calculator nhs tax calculator uses the latest. If you have filed with New Hampshire Department of Revenue Administration after 1998 you can pay your Business Enterprise Tax BET and Business Profit. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on.

Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. That will generally lead to a review of valuation and a possible refund of taxes paid. The new hampshire state tax calculator nhs tax calculator uses the latest federal tax tables and state tax tables for 202223.

The New Hampshire statutes governing interest rates were amended in 1995 Chp. For transactions of 4000 or less the minimum tax of. The New Hampshire State Tax Calculator NHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223.

If you make 70000 a year living in the region of New Hampshire USA you. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The median property tax on a 24970000 house is 464442 in New Hampshire.

This tax is only paid on income from these sources that is 2400. For Taxable periods ending on or after December. To estimate your tax return for 202223 please select the.

Census Bureau Number of cities that have local income taxes. This calculator is for 2022 Tax Returns due in 2023. New Hampshire income tax rate.

Line 10 The application will calculate the New Hampshire Interest and Dividends Tax and display the result. 54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. Line 11 Enter payments previously made from an a application for.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. 268 Laws of 1995 to require that starting on January 1 1998 and determined annually. To calculate how much tax you need to pay use the Estimated Tax Worksheet which is part of Form 1040-ES.

E-File Help - Business Tax Help. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. Ad Calculate Your 2022 Tax Return 100.

The 2021 real estate tax rate for the Town of Stratham NH is. New Hampshire Income Tax Calculator 2021. Your average tax rate is 1198 and your.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

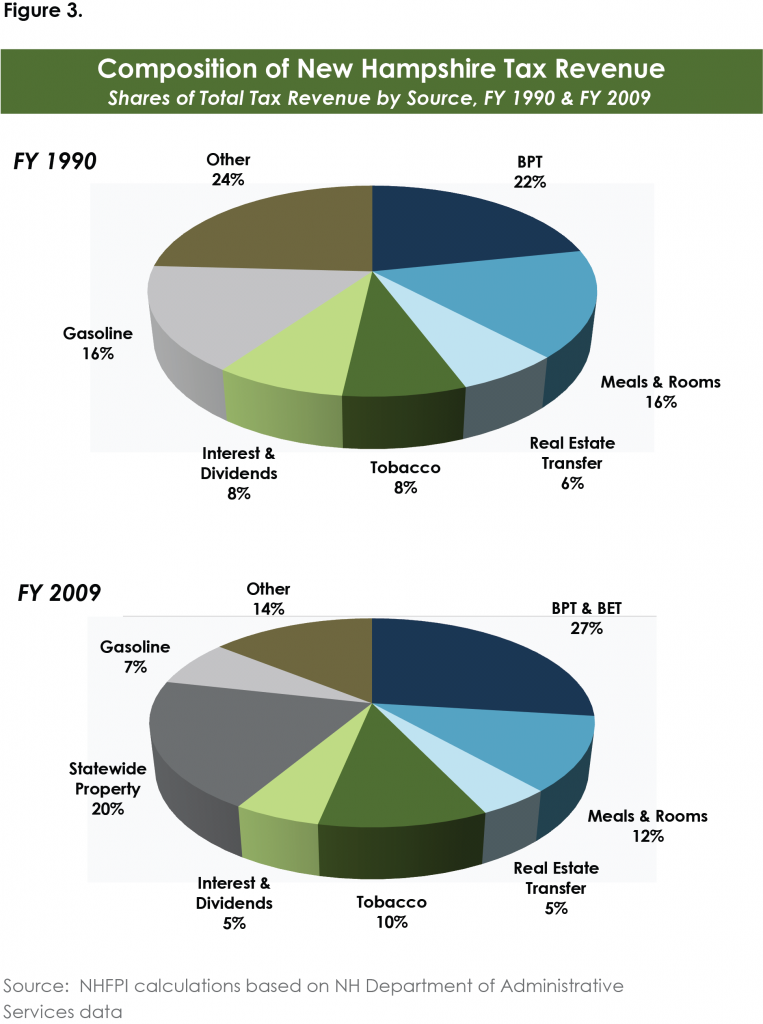

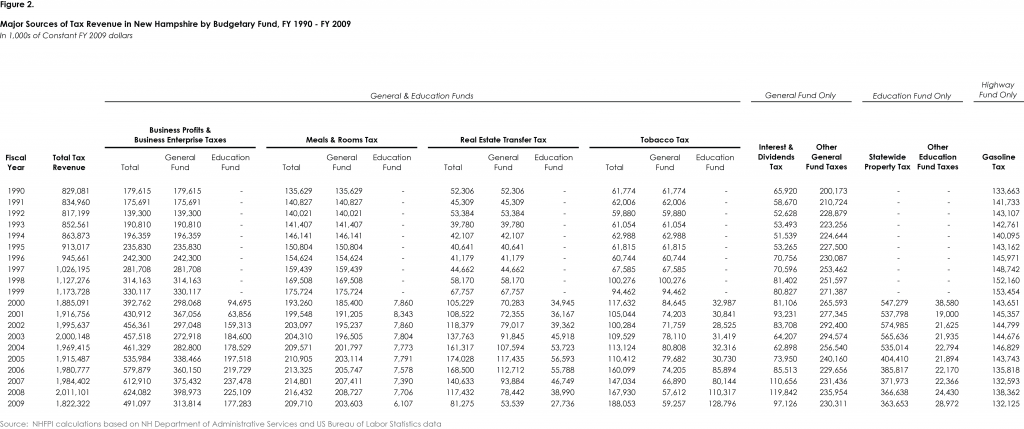

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Employment Taxes 101 An Owner S Guide To Payroll Taxes

How To File Taxes For Free In 2022 Money

Where S My New Hampshire Nh Tax Refund Nh Income Tax

2022 Federal State Payroll Tax Rates For Employers

Historical New Hampshire Tax Policy Information Ballotpedia

Best Free Tax Software 2022 Free Online Tax Filing Zdnet

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Do You Know How To Calculate After Tax Returns Russell Investments

Child Care Tax Credit Calculator Child Care Aware Of Nh

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Sales Taxes In The United States Wikipedia

New Hampshire Form 2290 E File Highway Vehicle Use Tax Return

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Estate Tax Everything You Need To Know Smartasset

Federal Deadline May Have Been Extended But Nh State Taxes Are Still Due April 15 Nh Business Review